Introduction

The Special Purpose Acquisition Company (SPAC) or Private to Public Equity (PPE)™ Initiative

Introduction

Sokféle módon lehet ingyen pénzt vagy pörgetéseket szerezni egy https://kaszinoworld.com/ . Rendszeresen vannak heti és havi ajánlatok, amelyeket a játékosok kihasználhatnak. Néhány ilyen promócióhoz még befizetés sem szükséges! Néhány ilyen promóció remek módja lehet az új játékok kipróbálásának. Ha ingyenes készpénzszerzési lehetőséget keresel, nézd meg a legjobb kaszinó promóciókat.

Sok kaszinó kínál promóciós programokat, amelyekkel a hűséges tagokat jutalmazzák. A játékosok pontokat gyűjthetnek, és ezeket ingyenes játékra, ételre és italra vagy üdülőhelyi kiadásokra válthatják be. A bónuszpontok gyorsított ütemben gyűlnek, ha részt veszel a megfelelő promócióban. A pontgyűjtő promóciók abban is segíthetnek, hogy indokolttá tegyék a játékot egy adott napon. Például egy játékos megduplázhatja az adott napon nyert pénzösszegét, ha bizonyos mennyiségű nyerőgépen vagy videópókeren játszik.

A VIP-program is remek módja lehet annak, hogy pénzt nyerj egy kaszinóban. A VIP-program tagjai a ranglétrán való feljebbjutással egyre több előnyhöz jutnak. Az ezüst tagok egy ingyenes kifizetést kapnak, míg a platina tagok négy ingyenes kifizetést. A fekete tagok korlátlan számú ingyenes kifizetést szerezhetnek. További előnyök közé tartoznak a versenybelépők és az extra befizetési bónuszok egyező százalékos aránya. Az ilyen típusú kaszinó promóciók rövid idő alatt jelentős mennyiségű ingyenes pénzt jelenthetnek.

For private companies seeking to enter the U.S. public capital market, the most commonly known method is the traditional Initial Public Offering (IPO). However, Wall Street’s current focus on the very large, so called “unicorn” companies has made access to this method of achieving a public listing very difficult for smaller, albeit successful and well positioned companies. Given this state of affairs, becoming a public company by merging with a Special Purpose Acquisition Company (SPAC) has become an attractive alternative for growth-stage companies.

For those who are not familiar with the term SPAC, it is a so called “blank check” company formed for the purpose of effecting a business combination with an existing operating company and thus allowing that company to become publicly listed in a very strait forward and efficient manner. Essentially, the SPAC entity forms a corporation, raises capital in an IPO, searches out an appropriate target company, completes an agreement to merge with that company and then effects the merger (typically within 6-8 months of the agreement to merge) resulting in the target company becoming listed through a “reverse merge” mechanism and under the SPAC’s “ticker” to be listed as a new traded company.

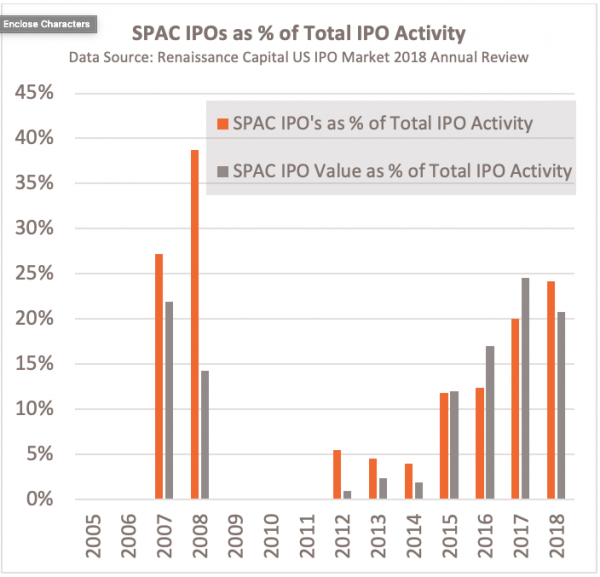

Because of its effectiveness in bringing companies public, the SPAC process has gained significant interest from the financial community as evidenced by the recent growth in the number of SPAC offerings. There has been an upward trend in SPAC IPOs since 2011, in both deal count and dollar amount raised. In 2018, SPACs counted for 24% of total U.S. IPO deals and 21% of IPO dollar value. As of October 2019, there are 90 active SPACs, which raised total of $17.63 billion, out of which 70 are in the process of searching for combination targets and 20 that have announced already the combination targets and expect to close the deals.

Why Consider a SPAC Transaction

SPACs typically address companies that are in late stage growth and have demonstrable Enterprise Values (EV) in the range of $200M to $500M or even up to few billions of dollars valuation, but nonetheless face significant challenges going through the standard IPO process because of their sub-unicorn status, or other factors that prevent them from completing a successful standard IPO. In those situations, utilizing the SPAC process offers significant advantages to the target company.

- Shorter process duration. While traditional IPOs can take several years to implement, SPAC combinations take on average 6 to 8 months to complete once a merger agreement has been reached and provided that the target company has been US GAAP/PCAOB audited for the prior two financial years. This significantly shortens the “time-to-market” for target companies.

Short process duration is desirable for targets from a valuation perspective because companies can capture market sentiment more effectively, thus being able to assume higher valuations. Additionally, in a fast-moving market, companies can move fast to acquire and consolidate the markets in which they exist. The traditional IPO process is considerably longer, so companies might not be able to react when market conditions change. Further, the shorter SPAC combination process minimizes the distraction to the target company leadership team, allowing them to stay focused on execution and growing the business.

- Immediate investment analyst attention. A SPAC transaction will result in awareness from investment bank analysts on the upcoming deal. However, in contrast to the SEC regulations controlling IPO transactions, the fact that the SPAC transaction is viewed as a merger and acquisition (M&A) activity on the part of the SPAC entity, which is already a public traded company, analysts are immediately allowed to ”be brought over the wall” and can review the proposed combined target, and thus provide perspective to prospective investors. As a result, the target company can benefit from having its current and future data published, and analyst input on future growth or any other valuation related questions that the institutional investors may have. This can help stimulate increased interest on the part of investors and lead to a more realistic valuation.

- Ability to provide forward-looking financial projections. In a SPAC combination, the target company can provide management’s forward-looking projections (e.g. the strategic growth plan), which is not allowed under the SEC regulations for companies that undergo traditional IPO process, prior to the completion of the offering. Visibility into a concrete future growth plan, such as few years future financial growth and the potential M&A pipeline for additional revenue expansion, is extremely beneficial to the support of the company valuation and to attracting interest from fundamental value investors.

- Favorable cost structure. The costs to implement a SPAC transaction typically are less than those associated with a traditional IPO. The SPAC entity sponsors typically pay a 2% underwriting fee at the time of the SPAC IPO, with an additional 3.5% underwriting fee (i.e. based on the SPAC IPO size) paid by combined company at the completion of merger. By comparison, the traditional IPO fees are typically 7% of the proceeds raised through the IPO process, which is commonly larger than the SPAC IPO size, and all that expense is borne by the company. Hence, the SPAC combination cost to the target company could be significantly lower than that of the traditional IPO.

- SPAC advantages relative to a direct listing. Recently, some larger companies have proposed direct listing IPO’s thus avoiding the banking fees associated with a traditional IPO. While this may be a possible alternative for large, well-known companies and “unicorns”, it is not a practical alternative for companies of a more modest size. Further, the direct listing process must operate under the same SEC structures that pertain to a traditional IPO, thus it is not allowed to present forward-looking projections.

The Unique Advantages of Working with GigCapital

In addition to the aforementioned general advantages of a SPAC transaction, the GigCapital team brings a unique set of additional advantages. Our team is a deeply experienced group of executives, comprising former CEOs and technical experts that bring expertise and insights across technologies, operations, strategic planning and execution, private and public market financing, mergers and acquisitions and senior leadership level experience. As successful entrepreneurs and industry leading multinational corporation executives, the GigCapital partners cover the end-to-end needs of the target company as it enters the universe of publicly traded companies, including strong relationships with Wall Street.

We refer to our unique approach to the SPAC process as a Private-to-Public Equity (PPE™) transaction that is characterized by the following attributes:

- Ongoing support of the company through our Mentor-Investor™ involvement that typically includes providing expert Board of Director participation.

- Leveraging our extensive investment banking relationships to assist the company in subsequent financing activities such as Private Investments in a Public Entity (PIPE), secondary offerings, debt financing, etc.

- Extensive experience in M&A transactions as a method to rapidly grow the business.

- Mentorship to senior management as they grow and develop the business and face the inevitable challenges associated with that growth.

- Through our personal networks providing important introductions to industry leaders and executives on a worldwide basis, as well as investment banks, research analysts, institutional investors and debt landers